Biometric Payment Cards

Publication Date: March 2019

- Click here to download the white paper.

- Listen to the Payments Council Biometric Payment Cards webinar

The payment industry continues to push for payment authentication methods that improve on traditional methods while minimizing disruption to the card manufacturing process. With this in mind, some card vendors, technology suppliers, and solution providers are redefining what could become the next standard for payment technologies with cards—biometric authentication. Biometrics has always provided a way to address multifactor authentication, fulfilling the “who you are” factor requirement and working in conjunction with “what you have” (a card) and “what you know” (a PIN).

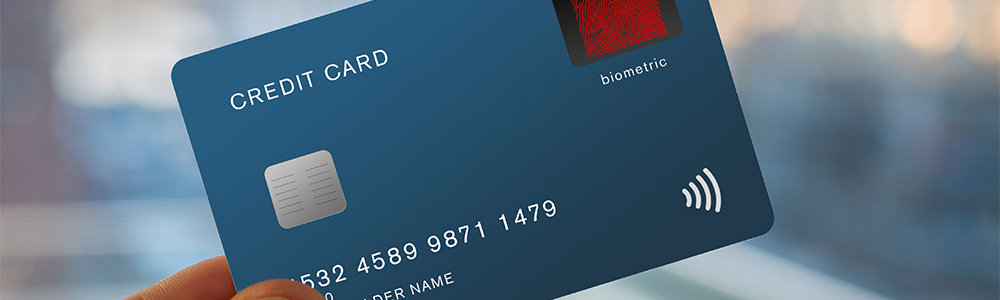

New developments are opening the door to a new type of payment card, a biometric card that relies on the prevalent user-to-mobile authentication technology—fingerprints—for authentication. Such a card can change the way cardholders authenticate themselves for a payment transaction. Although the implementation models differ, new technologies enable on-card template matching and storage in the secure element, battery-free operation, and fast transactions.

This white paper provides a primer on biometric payment cards for issuers, issuer processors, payment networks and merchants. The white focuses on a specific implementation – one that incorporates fingerprint capture, template storage, and matching on the payment card itself. The white paper discussions:

- Biometric payment card technology

- Fingerprint enrollment methods

- The biometric payment card transaction process

- Benefits of biometric payment cards

- Implementation considerations

- Real-world examples of biometric payment card implementations

About this White Paper

This white paper was developed by the Secure Technology Alliance Payments Council to provide a primer on biometric payment cards for issuers, issuer processors, payment networks and merchants. Secure Technology Alliance participants involved in the development of this white paper included: American Express; CPI Card Group; Discover Financial Services; Entrust Datacard; First Data; G+D Mobile Security; Gemalto; IDEMIA; Infineon Technologies; Ingenico; Mastercard; MULTOS International; NXP Semiconductors; Rambus; Verifone; Visa.